A framework to understand all software partnerships

This is part of a series covering the welcome keynote.

- Software partnerships are unpredictable revenue (0:00)

- A framework to understand all software partnerships (9:33)

- Breaking the SaaS love triangle (14:33)

As we discussed before, partnerships can feel like unpredictable revenue. It can seem to some like there’s no rhyme, nor reason for how partnerships work.

But we have learned some things about partnerships over the years. I’m going to give you a little framework in this post to think about partnerships.

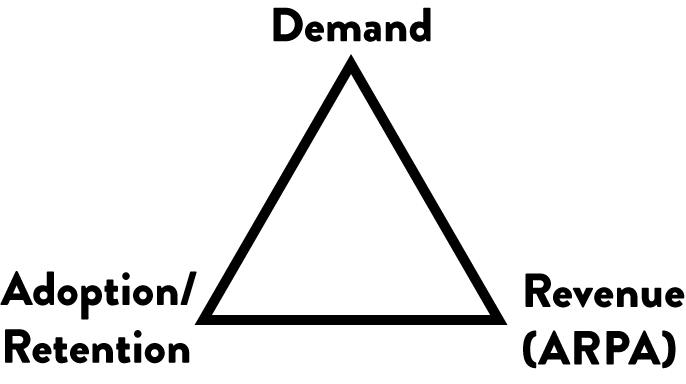

The 3 SaaS partnership revenue metrics

The KPIs to measure revenue of SaaS partnerships

There are 3 primary KPIs to measure partnership revenue:

- Demand driven. Partnerships that get you more volume at the top of your funnel that lead to more signups and more subscriptions.

- Stickier adoption and retention. While harder to track, it’s critical to convince customers to adopt software and then keep using it. Partnerships help build a whole product solution that is more compelling to your customers.

- Higher average revenue per account (ARPA). Upselling and cross-selling your customers on partner products and services increases the total money captured from each customer.

Every partnership deal you do can be analyzed by impacting one or maybe two of these metrics to see what the return on investment (ROI) might be.

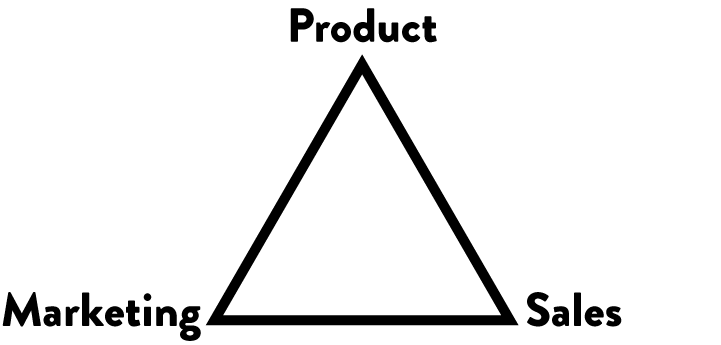

The 3 partnership levers

Software partnerships work by leveraging one of 3 dimensions of power.

An effective partnership leverages something the partner has in order to help you. If you’ve ever heard of the investment principle of leveraging “OPM” (Other People’s Money), this is the same concept but for partnerships. There are 3 principle levers in technical partnerships:

- Other people’s product. Building a whole product solution out of component parts. For instance, putting a CPU in a laptop, or integrating applications together.

- Other people’s marketing. Gaining distribution to a new or wider market through a partner’s channel. For instance, app stores, referral sites like G2crowd, or retail distribution like Staples.

- Other people’s sales. Having the partner resell your product to their customers. For instance, agencies and consultants, bundled cross-sales, or master/agent reseller channels.

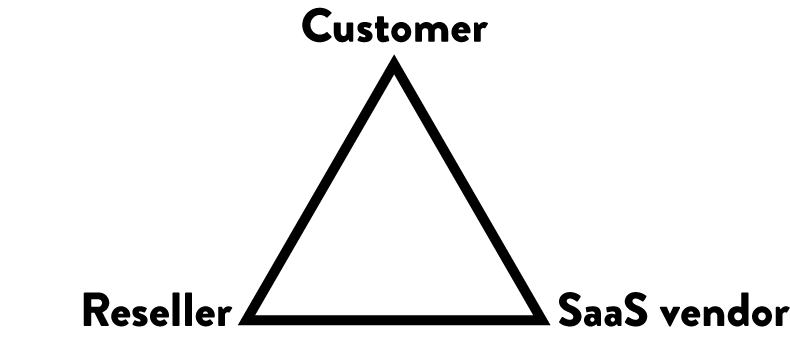

The love triangle of SaaS

Fighting over the customer is a bad idea

Unfortunately, the SaaS business model has a fundamental problem. The subscription billing model requires a customer to have a direct relationship with the software maker. After all, how do you create a recurring stream of payments without a direct contract between customer and software maker?

This forces SaaS into a direct sales and direct marketing model.

So when a reseller or distributor gets in between the customer and the software maker, it makes a love triangle. The partner and the software maker fight over the customer.

This creates a lot of friction building a distribution channel, as conflict with your partners is a good way to snuff out a relationship. Not to mention, you can only create a channel if you are giving up room for others to create value around you.

To quote Bill Gates on what makes a platform work:

“A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. Then it’s a platform.” — Bill Gates

Case in point: How the industry changed when the partnership levers changed

To understand the state of the software partnership market today, let’s work through this model by comparing now to the PC market in the eighties.

PC product integrations were weak

In the PC world, unlike today, product integration was actually pretty weak because it was really hard to do application-to-application data sharing. Product integration was primarily vertical: from the computer to the operating system, to the application stack.

This very tight integration led to opportunities like WordStar being bundled with Osborne computers and Lotus being the killer app for the official IBM PC. Vertical integration sold a lot of units. But horizontal partnerships between apps was very difficult.

PC software dominated because of resellers

However, where the PC market really dominated was leveraging Other People’s Sales with the reseller market. Resellers or value-added resellers (VARS), as we would call them, would buy the hardware and buy this new stuff called “independent software” from “independent software vendors” (ISVs) and stitch it together to build a complete solution to sell it on to end customers as their own product.

These ISVs made a great advance called the “software license” which was fundamental to the reseller channel’s rapid growth. Software licenses let you put diskettes in a box and ship them through the retail distribution to all these shopping malls in America. It was a huge distribution network.

SaaS reseller partnerships are weak

But SaaS is different because it’s very difficult to resell SaaS. After all, how do you resell a subscription? How do you put a subscription in a box and ship it? You can’t.

Consequently, when working with resellers, most of us rely on a referral model—or an affiliate model, which is basically a referral model. Distribution is consequently very typically referral-based. When you’re looking at G2Crowd or GetApp or generating leads from app marketplaces, it’s referral-based distribution rather than true resale.

Of course, referrals are much weaker than a resale distribution chain because the transactions are indirect. This creates an inefficient market and slower growth.

SaaS product integrations are strong

Truthfully, that there’s a partner ecosystem in SaaS at all is because of product partnerships.

SaaS is really software on a network. Unlike the PC days, the network allows the data to be integrated, which allowed us to create product-to-product integrations, which allows software companies to create a partner network from their integrations.

Interestingly, product integrations in SaaS are different than the PC days, where most integrations where component integrations. For instance, put a CPU in a laptop. That’s great because you have a 100% market penetration because the CPUs are in every laptop.

SaaS is not like that. We have horizontal connections, indirect connections. We create a web of software so it’s always a smaller conversion rate.

If you’re finding your product integrations are not creating hockey-stick growth, it’s because we’re doing these side-to-side web of product integrations rather than a component/stack integration.

Indeed, if we want the market penetration of component integrations, the future of SaaS product integration may be more embeddable widgets.

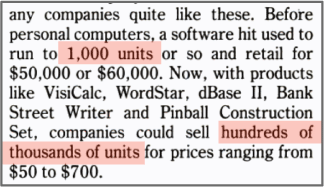

Economics of reaching the shopping malls of America

Low cost, high volume distribution sold 700,000 units of WordStar in one year.

Finally, the biggest difference in economic terms that led to the PC revolution was that the cost of software dropped by magnitudes. In the 1970s, Demand was low but Average Revenue Per Account was very high. If you sold 1,000 units each at tens of thousands of dollars plus service contracts, you’d have a good company.

The PC revolution changed the equation. The top companies sold software at consumer prices because they prioritized maximizing demand through the retail distribution system.

This kind of channel strategy does not rely on a sales team strategy at all. It requires a partnership strategy.

Breaking the SaaS love triangle

But the key lesson here is that the partnership strategy truly shines when there’s a mechanism to allow the channel to create a “value chain” from the manufacturer to retail.

The future will require that we find a way to change SaaS to stop the channel conflict.

There might be an answer. Read the next part in the series: Breaking the SaaS love triangle.